tax liens in dekalb county georgia

Display County Index Data Good FromThru Dates. For individuals enter last name first name Display Results From optional.

Tax Commissioners Office provides payoff amount interest fees Petitioner is notified of the payoff amount and Petitioner provides 75 cashiers check for processing fee made payable to DeKalb County DeKalb Board of Commissioners BOC votes to either approve defer or deny the sale of tax interest.

. Just remember each state has its own bidding process. Mmddyyyy Example for Date Range Searches. Ad Search Information On Liens Possible Owners Location Estimated Value Comps More.

Once the lien has been issued the lien is submitted to the sheriffs department and. 11 248 03 020. Select a county below and start searching.

Petitioner pays full payoff amount. In order to redeem the former owner must pay Dekalb County None 20 penalty of the amount. Debit Credit Fee 235 E-Check Fee FREE.

Search Any Address 2. Dekalb County GA currently has 2984 tax liens available as of February 11. Find the best deals on the market in Dekalb County GA and buy a property up to 50 percent below market value.

Dekalb County GA tax liens available in GA. Property tax liens are used on any type of property whether its land your house or commercial property. Our real estate records date back to 1842 when the former records were lost in fire.

11 248 03 020. Georgia Requires Tax Parcel Identification for all DeKalb Property Transfer or Conveyance Filings as of July 1 2019 in accordance with House Bill 694 HB 694. Though the Tax Commissioners Office does not report information to credit agencies a tax lien may appear on your credit reports and.

Shop around and act fast on a new real estate investment in your area. Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate. When the lien is issued the county or town that is owed property taxes creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties.

Tax Sales are held on the first Tuesday of each month between the hours of 10 am and 4 pm on the steps of the Fulton County Courthouse 136 Pryor Street SW except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Online Property Liens Information At Your Fingertips. There are more than 10781 tax liens currently on the market.

Ad Find The Best Deals In Your Area Free Course Shows How. Ad Property Liens Info. 6758 BROWNS MILL LAKE RD.

Georgia Tax Lien Homes. DeKalb County Property Records are real estate documents that contain information related to real property in DeKalb County Georgia. It is also the first step in taking the property to tax sale.

If you do not see a tax lien in Georgia GA or property that suits you at this time subscribe to our email alerts and we will update you as new Georgia. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. A tax lien is a claim or encumbrance placed on a property that authorizes the Tax Commissioner or the Sheriff to take whatever action is necessary and allowed by law to obtain overdue taxes.

Check your Georgia tax liens rules. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Dekalb County GA at tax lien auctions or online distressed asset sales. At such time that any state tax lien or.

See Available Property Records Liens Owner Info More. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. This is the searchable electronic filing submission docket as provided for by Georgia Code 15-6-973 and is effective January 1 2018.

A courtesy listing of properties up for sale is available in the. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of superior court. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

Property Tax Online Payment Forms Accepted. This is a period of time in which the former owner can reclaim the property by repaying the amount bid at the Dekalb County Tax Deeds Hybrid sale plus None 20 penalty of the amount for the first year or fraction of a year and 10 penalty for each year or fraction of a year thereafter. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

In fact the rate of return on property tax liens investments in Dekalb County GA can be anywhere between 15 and 25 interest. Search all the latest Georgia tax liens available. Ad Find Tax Lien Property Under Market Value in Georgia.

Public Property Records provide information on homes land or commercial properties including titles mortgages property.

Tax Sale Dekalb Tax Commissioner

Tax Sale Listing Dekalb Tax Commissioner

Tax Sale Listing Dekalb Tax Commissioner

Chamblee Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Dekalb County Release Of Claim Of Lien Form Georgia Deeds Com

Tax Sale Listing Dekalb Tax Commissioner

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Click2skip Dekalb Tax Commissioner

Dekalb County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

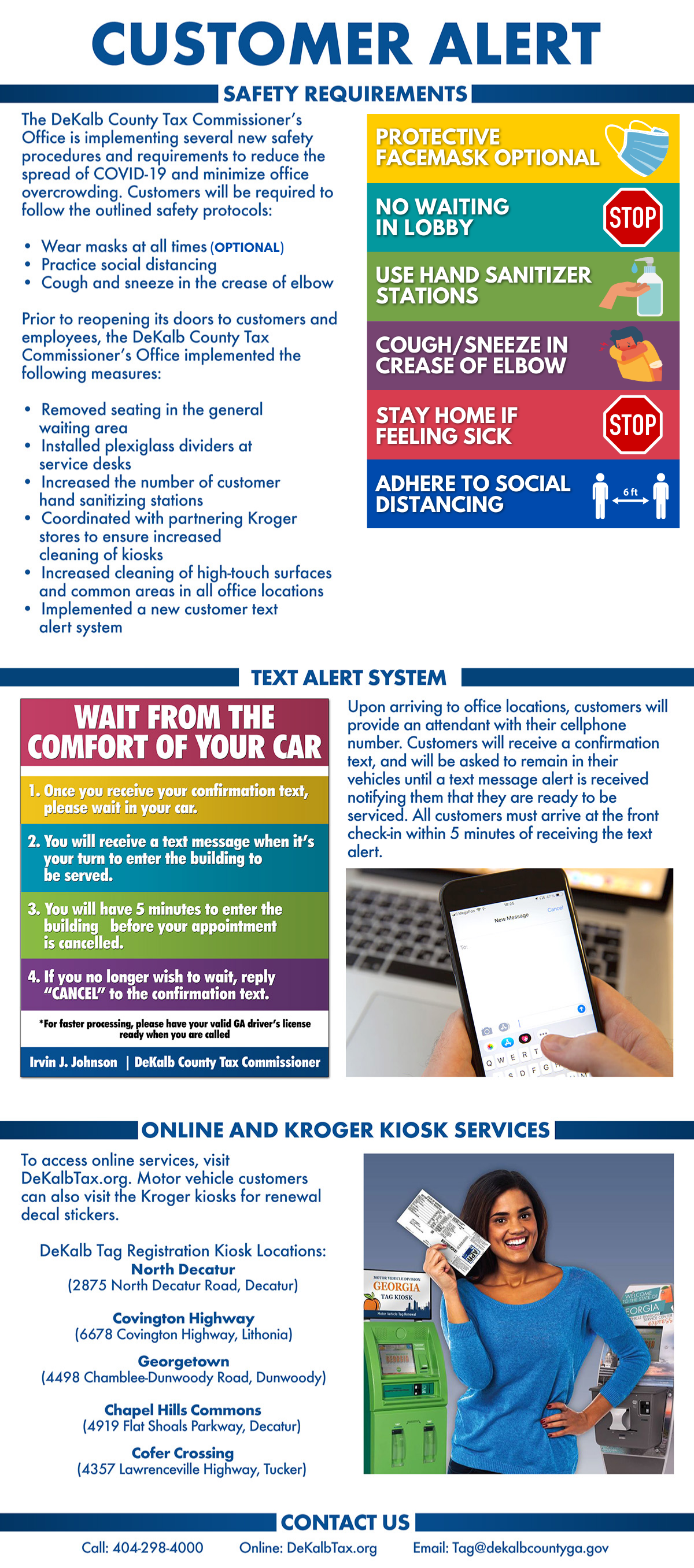

Covid 19 Customer Alert Dekalb Tax Commissioner

Dekalb County Auction Dekalb County Ga

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

Tax Sale Listing Dekalb Tax Commissioner